In the realm of love and adventure, couples are akin to explorers embarking on a thrilling journey together. Together, they build a shared life, navigating through financial landscapes that can sometimes feel treacherous. But what if I told you that, like any great journey, there were ways to make the trip sweeter without breaking the bank? Today, we’re diving into the world of money-saving tips for couples—those brilliant strategies to help you and your partner not just survive, but thrive in financial harmony. Whether you’re seasoned travelers in the realm of finance or just starting out, these insights will make your cash flow easier to manage.

Have you ever sat across from your partner, perhaps over a mug of coffee in the early morning light, and envisioned how many adventures you could go on if only the dollar signs in your bank account didn’t seem to loom larger than life? Trust me; you’re not alone. Couples who team up on finances have a unique advantage, sharing both burdens and rewards. But to harness this power effectively, you need to communicate openly, plan together, and celebrate milestones along the way. Let’s explore some money-saving tips that can open up a world of possibilities for the future you both dream of.

Why Couples Should Team Up on Saving

Couples possess a remarkable advantage when it comes to finances—the power of synergy. Imagine each partner as a vital thread in a tapestry; together, you create something beautiful and far stronger than any individual thread could accomplish alone. Combining incomes and sharing expenses fosters collaboration that can reduce waste and accelerate savings. Statistics reveal that couples who engage in financial teamwork experience less stress and are more likely to achieve critical milestones like buying a home or enjoying a grand adventure abroad. But here’s the catch: success boils down to honest communication and clear joint goals.

Consider this a call to arms. When was the last time you had an open conversation about your money? A few months ago, my partner and I initiated “money dates,” a casual sit-down where we sipped wine, reviewed our budget, and discussed upcoming expenses. What started as a daunting task quickly transformed into a ritual that brought us closer; I watched as my partner lit up, sharing dreams of traveling to Europe together. We jotted down our goals—both immediate and long-term—in a notebook marked “adventures.” This simple act illuminated the future we both wanted, and suddenly, saving money felt like a steppingstone toward our adventure rather than a restriction.

1. Open, Honest Communication About Money

None of the other money-saving tips will matter unless you lay a strong foundation with open financial communication. Talk about your attitudes towards spending, saving, and even debt. Ask yourself questions like, “What do I spend on without thinking twice?” or “What financial fears keep me up at night?” You might be surprised by the answers that emerge during these heart-to-heart talks.

Setting aside time regularly—perhaps on that “money date”—to discuss your financial standing is crucial. Maybe you’ll find common ground on your shared goals, or perhaps you’ll stumble upon minor discrepancies that can be easily adjusted. I remember an evening when my partner and I reconciled overspending on takeout, agreeing to cook together more often. Reducing eating out didn’t just lighten our financial load; it reignited our love for cooking as a team. And let me tell you, nothing lets you know you’re on the same financial wavelength like tackling a recipe that goes hilariously wrong!

2. Create a Joint Budget

Step two: draft a joint budget. Think of this as your treasure map, guiding your expedition toward financial bliss. Gather your treasure—combined income and necessary expenses—then chart your course onto paper (or an app, if you prefer digital maps). The key is to settle on a budgeting method that harmonizes with your lifestyle.

Here are a few options to consider:

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings.

- Envelope Method: Assign cash for categorized expenses—once it’s gone, it’s gone.

- Zero-Based Budgeting: Every dollar has a task; leave no room for waste.

- Pay Yourself First: Prioritize savings before other bills hit.

- No-Budget Budget: Track only essentials and savings, indulging in the rest without limits.

Choose a method that feels right for you and revisit it regularly. What’s important is setting an expectation and maintaining a balance that is both structured and flexible enough to accommodate life’s curveballs.

3. Set Shared Financial Goals

Now, let’s talk about the dreams. What kind of life do you envision together? Do you sail through thoughts of buying a cozy home, traveling the world, or maybe retiring early while sipping cocktails on a beach? Write down your shared financial goals, breaking them into actionable steps.

When my partner and I put our heads together to outline our financial ambitions, it was like flipping a switch. We went from vague ideas to concrete plans—setting dates for saving up for a romantic getaway to Bali, and budgeting for family visits. Celebrating our little victories along the path—like snagging a great deal for a concert—only sweetened the deal. Remember, staying flexible is key; sometimes your “wants” may change, and adjusting aspirations can bring you even closer.

4. Automate Your Savings and Bill Payments

Automation is like your trusty sidekick on a journey. Set up recurring transfers to a savings or investment account as soon as you get paid. This ensures that money flows toward your dreams without the temptation to splurge. Many banks allow you to automate bill payments, which can keep those late fees at bay and free up mental space for more exciting pursuits.

Take it from me: after setting up autopay for our bills, we found ourselves with extra time and less stress over due dates. Plus, our saving accounts began to grow steadily without us needing to constantly micromanage our budget. Automate and relax—your future self will thank you.

5. Cut Unnecessary Expenses and Subscription Overlap

Ah, the hidden costs of modern living. Together, take a magnifying glass to your spending—what do you find? Are you both subscribed to different streaming services? Do you really need all those gym memberships? Tackle these questions head-on.

We discovered we were overpaying for groceries by not planning meals in advance. By brainstorming meals together and shopping with a list, we not only cut down on costs but also made grocery shopping an enjoyable activity. After all, who doesn’t love strolling through the produce aisle together?

6. Track Your Spending Together

Knowledge is indeed power. Use apps to track your spending and keep one another accountable. Review receipts, share screens, and discuss monthly trends—this collaborative approach will highlight where changes can be made. Plus, witnessing your finances improve over time can be highly motivating.

My partner and I introduced a monthly finance check-in, where we analyzed our expenses, celebrated our milestones, and set new goals. We even turned it into a fun challenge. How much can we save this month compared to last? Competing was exciting, and it strengthened our partnership.

7. Build an Emergency Fund and Plan for the Unexpected

Life can sometimes feel like an unpredictable road trip—unexpected twists and turns are often just around the corner. Building an emergency fund to cover three to six months of living expenses is essential. This safety net protects you from stumbling financially when life throws a curveball.

Start by saving even a little each month, then revise it as necessary. My partner and I maintained our emergency fund by adding a small percentage of any bonus or unexpected cash flows we received. Just like that, feeling more secure about our finances helped us breathe easier—and enjoy the ride.

Conclusion: Financial Teamwork for a Brighter Future

In conclusion, saving money as a couple can turn into an empowering experience filled with shared adventure and joy. By embracing open communication, setting goals, being diligent about tracking expenses, and planning for the unforeseen, you’ll not only ensure greater financial stability but strengthen the partnership that brought you together in the first place.

Remember, every step you take as a team brings you closer to your shared dreams. Let these money-saving tips be your guide to a joyous financial journey together.

So, grab a glass of wine, set those “money dates,” and embark on this rewarding endeavor together.

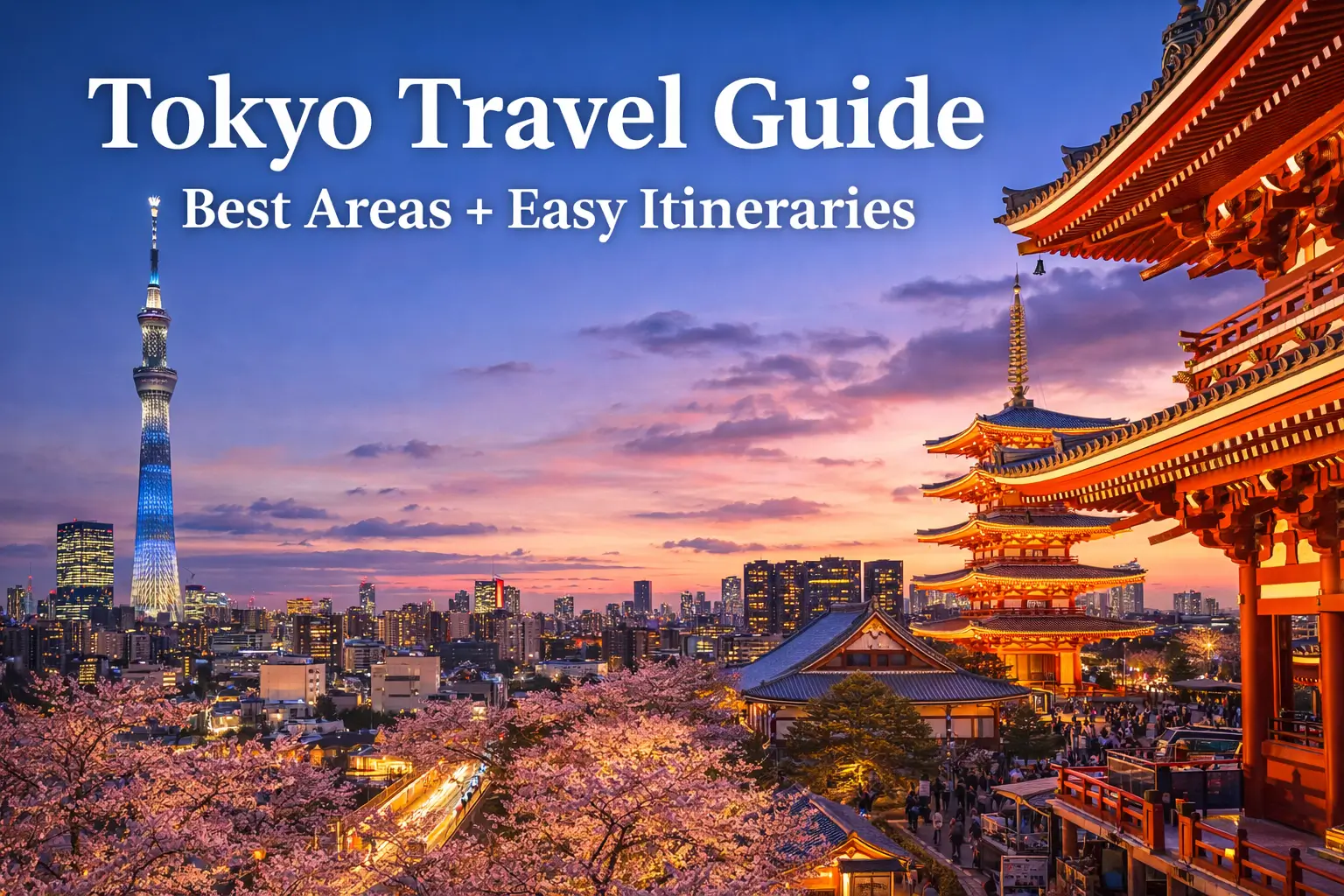

Improve your adventure with these guides:

- Unlock Unbelievable Travel Deals How Bundling Flights and Hotels Can Save You Hundreds for bundled savings.

- Master the Art of Travel Unlock Free Hotel Stays with Points and Save Big on Your Next Adventure for points hacks.

- Airbnb vs Hotels Discover the Best Travel Accommodation for Your Unique Adventure for accommodation choices.

- 10 Irresistible Bangkok Street Food Delights You Must Try for an Unforgettable Culinary Adventure for food exploration.

- Discover the Power of Wise Card for Travelers’ Savings.

Want to stay updated on the latest travel tips? Check out our Travel Tips section: Travel Tips! Looking for lifestyle inspiration? Explore our Lifestyle category, and discover amazing destinations! Connect with us on YouTube, or follow our adventures on Instagram and Pinterest.

Wishing you all the joy and adventure as you walk this path together!