Finding the Best Budget Travel Rewards Credit Card: A Comprehensive Guide

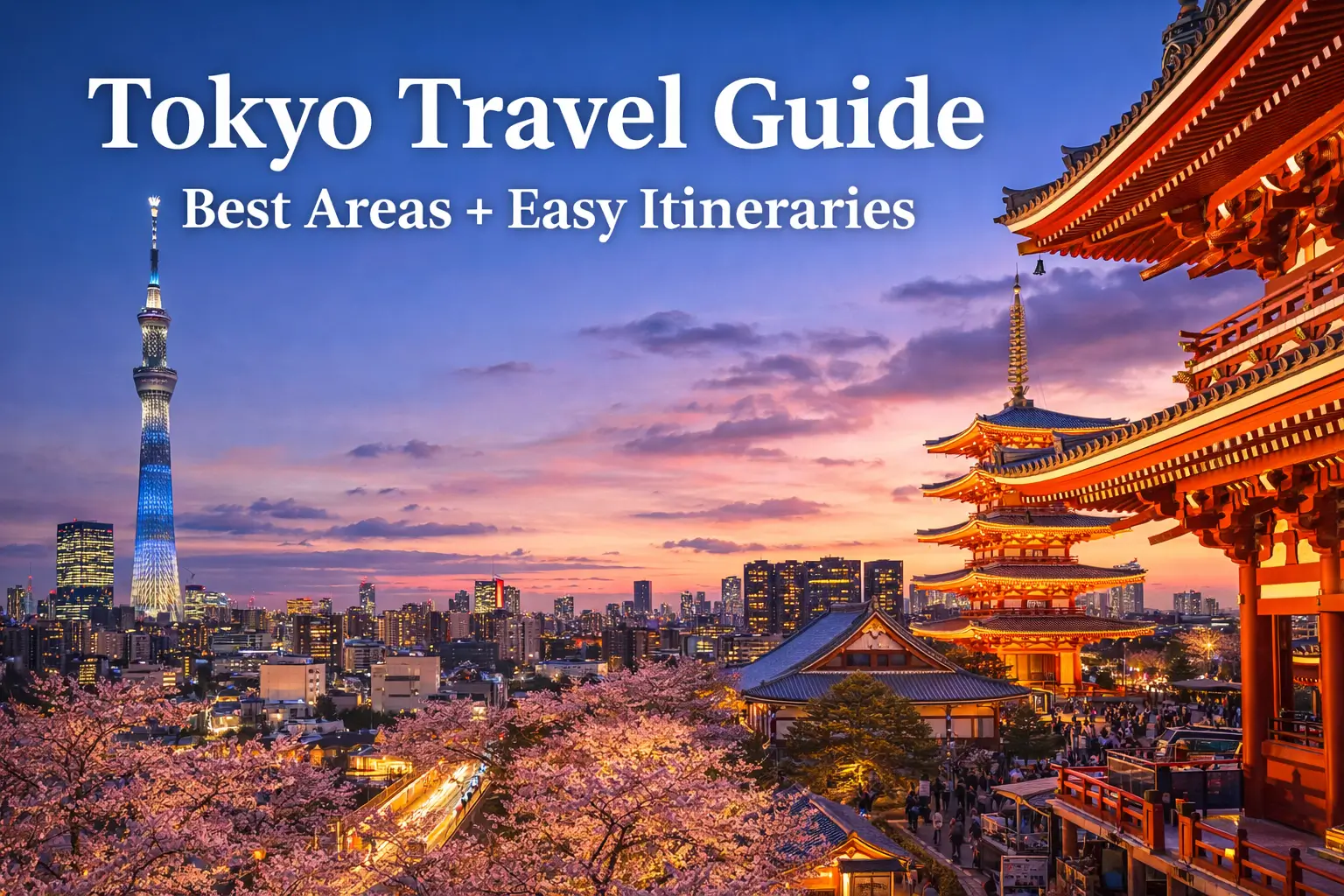

In the shifting sands of today's economy, the wanderlust within many travelers often collides with the harsh reality of budget constraints. You stand at the crossroads of desire and practicality—dreaming of azure oceans, cobblestone streets, and the taste of culinary delights from around the globe, yet your wallet whispers caution. Enter the realm of budget travel rewards credit cards. These cards can transform the act of spending into gateways of exploration, brightly colored maps unfurling at your feet. But how do you choose the right card that offers both rewards and affordability? Let this guide take you through the intricate landscape of travel rewards.

Understanding Budget Travel Rewards Credit Cards

What Are Budget Travel Rewards Credit Cards?

These cards promise a passport to adventures, but they wear the cloak of affordability. They allow you to accrue travel rewards without hefty annual fees, making them a practical choice for travelers who don’t want their wanderings weighed down by financial burdens. Earning points or miles doesn't have to feel akin to trekking uphill; it can be as simple as buying your morning coffee.

Key Features to Look For:

When navigating this vast domain, there are several cardinal features to keep in mind:

- Low or No Annual Fee: Cards without annual fees help you save those extra dollars for the delicacies of your next destination.

- Flexible Rewards Redemption: You want options—whether for flights, hotel stays, or those spontaneous local delights that shimmer in the marketplace.

- Easy Earnings: Seek cards with clear, uncomplicated structures—flat-rate rewards can make the journey smoother, especially for novices.

- No Foreign Transaction Fees: If your adventures carry you across borders, this feature is essential to remove the sting of hidden charges.

Top Budget Travel Rewards Credit Cards

As we delve deeper, let’s highlight some stars in the constellation of budget travel rewards credit cards. Each of these cards offers unique benefits that cater to budget-conscious travelers without compromising the right to explore.

1. Bank of America® Travel Rewards Credit Card

– **Annual Fee:** $0

– **Rewards Rate:** 1.5 points per dollar on all purchases, with 3 points per dollar on travel booked through the Bank of America Travel Center.

– **Welcome Bonus:** 25,000 points after spending $1,000 in the first 90 days.

– **Redemption:** Points can be redeemed as statement credits for travel purchases.

– **Pros:** Zero annual fee, no foreign transaction fees, and a simple process for redeeming points.

A traveler once told me, "I booked my entire trip to Europe using my points from this card. It felt like finding a hidden treasure!" The thrill of exploration was never diluted by the worry of expense.

2. Capital One VentureOne Rewards for Good Credit

– **Annual Fee:** $0

– **Rewards Rate:** 1.25 miles per dollar on all purchases.

– **Welcome Bonus:** None mentioned, but it offers flexible redemption options.

– **Redemption:** Miles can be redeemed for travel purchases with no blackout dates or restrictions.

– **Pros:** A card that knows how to keep it uncomplicated, with no foreign transaction fees.

"It's like having a well-mannered travel buddy who always finds the best deals,” a youthful traveler remarked after using her card to book last-minute flights without hassle.

3. Chase Sapphire Preferred® Card

– **Annual Fee:** $95

– **Rewards Rate:** 5x on travel purchased through Chase, 3x on dining and select streaming services, 2x on other travel.

– **Welcome Bonus:** 60,000 points after spending $4,000 in the first three months.

– **Redemption:** Points sparkle with greater value—25% more when redeemed for travel through Chase.

– **Pros:** High rewards accumulation on travel expenses, plus flexible options for redemption including the allure of hotel and airline transfers.

Imagine sitting beside a campfire, sharing tales of distant lands conquered, where each point tells a story of its own, reflecting not just money saved, but experiences gained.

Tips for Choosing the Right Card

Choosing the right credit card is akin to picking the right travel companion. Consider these vital tips:

- Consider Your Travel Habits: Understand where you roam. Loyalty to a particular airline or hotel can enhance your rewards through co-branded cards.

- Plan Ahead: Timing is everything in life and travel. Apply for a card at least five months before a planned trip to take full advantage of the sign-up bonus.

- Avoid Debt: It’s crucial that you are financially ready. Pay off existing debts before adding new cards to your wallet, ensuring travel doesn’t come at a cost of financial strain.

Maximizing Your Rewards

Now that you’ve selected the right card, how do you spice up your earnings? Here are strategies to keep your rewards soaring high:

- Use Bonus Categories: Dive into higher rewards rates on specific spending categories like the delightful joys of dining or travel.

- Combine Points: If you gather cards under the same issuer, enjoy the luxury of combining points—greater redemption power rests in your hands.

- Monitor Promotions: Stay alert for special offers or limited-time bonuses; they could be the cherry on top of your reward sundae.

Conclusion

In the navigation of life, every path full of adventure bears a choice. Finding the best budget travel rewards credit card is about balancing dreams with reality; it’s about paving a road of tangible rewards that lead to unforgettable journeys. By understanding your personal travel habits and adhering to your budget, you can transform everyday purchases into pathways of exploration.

As you reflect on your travel plans, consider how each decision branches out—the credit card you select can reverberate positively through your future travels. Discovering the blend of practicality and aspiration as you chase sunsets and savor authentic street food in Rome, you’ll realize that living well is about finding joy—even in the choices you make.

Explore more of our insightful reads in the Travel Tips section for the latest advice. Craving inspiration for your lifestyle? Check out our Lifestyle category, and dive into amazing destinations at Destinations. Don't forget to connect with us on YouTube or follow our adventures on Instagram and Pinterest.