Traveling is a thrilling dance of spontaneity and discovery, filled with the heart-pounding rush of boarding a plane one moment and sipping coffee in a sunlit café the next. But amidst the whirlwind of excitement, life can surprise you in unintended ways. It can be as simple as a missed flight or as serious as a sudden illness while exploring a bustling market. This is where a travel emergency fund becomes your safety net, transforming what could have been a disaster into a mere bump in your exciting journey. You deserve the peace of mind that comes with knowing you’re financially prepared for whatever life throws your way!

Isn’t it comforting to think that you can travel with both freedom and security? In the lines that follow, we’ll forge through stories, practical tips, and heartfelt insights to help you create your own travel emergency fund.

Understanding Emergency Funds

Before we embark on this journey together, let’s pause a moment to understand the concept of emergency funds. Think of an emergency fund as your shield, protecting you from life’s unexpected battles. While a traditional emergency fund covers three to six months of living expenses, a travel emergency fund is like a specialized toolkit. It’s tailored to those unique bumps and curves you might encounter while globe-trotting.

Imagine a warm evening in a foreign city. You’re surrounded by twinkling lights, laughter floats in the air, and suddenly, your phone vibrates with the news—you must catch the next flight home due to a family emergency. Without a travel emergency fund, the cost of rescheduling could lead to scrambling for loans or dipping into your savings. With the fund, however, you simply tap into your financial safety net and focus on making it to the airport.

Why Do You Need a Travel Emergency Fund?

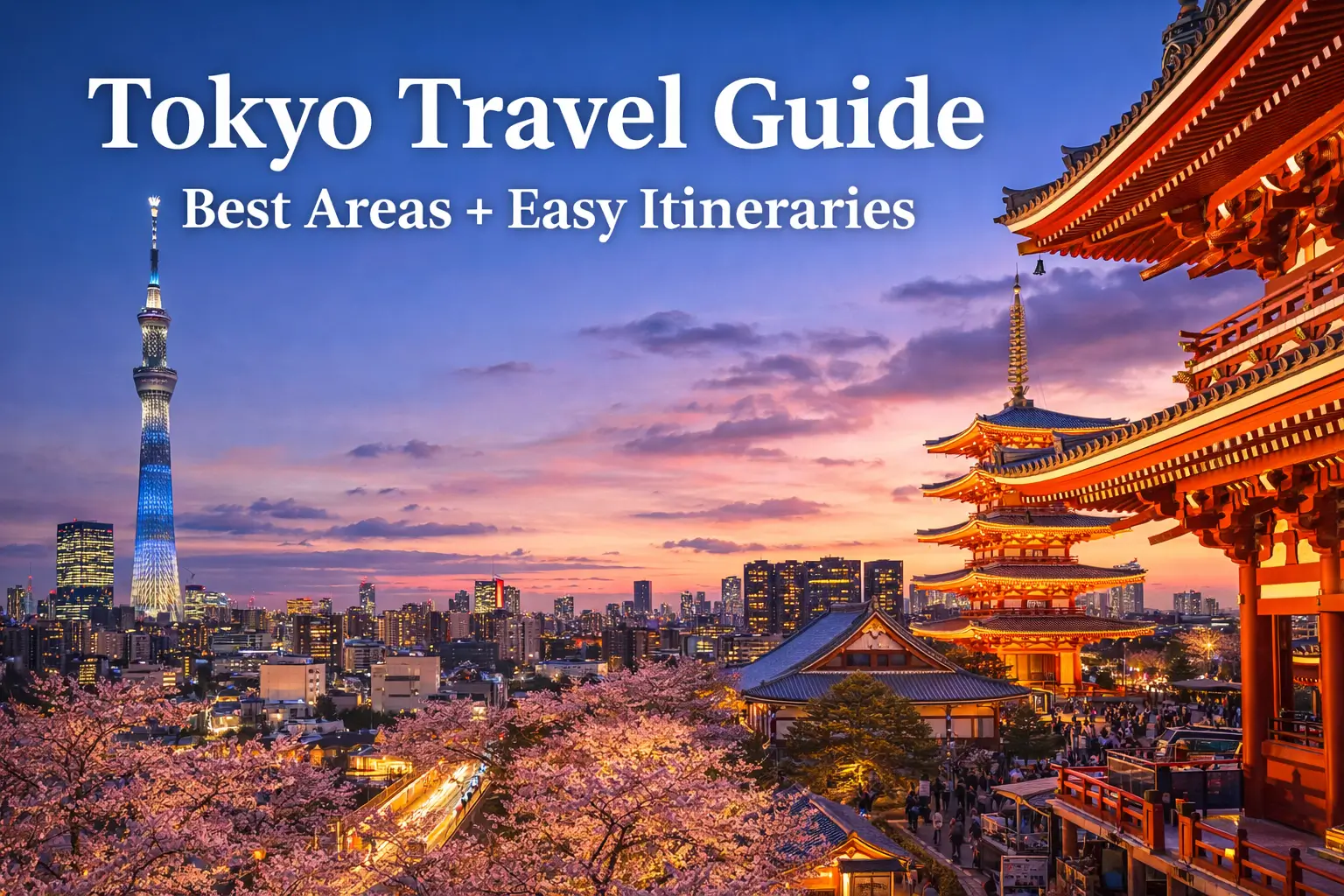

Traveling, while exhilarating, can be riddled with uncertainties. Flight cancellations, lost belongings, and unexpected medical needs often lurk in wait. A travel emergency fund addresses these specific risks. For instance, I once found myself in a charming little town in Italy when I received a call about my dog needing veterinary care back home. Both heart-wrenching and surreal, I remember feeling helpless. Thankfully, I had a bit saved up that allowed me to change my flight without breaking the bank or sacrificing my travel plans.

Having a travel emergency fund means you’re not just planning for peace of mind, but rather creating a buffer that allows your adventures to flow uninterrupted. It provides a layer of tranquility so you can focus on indulging in local delicacies or wandering down winding streets instead of stressing about finances.

How to Create a Travel Emergency Fund

Now that we understand the significance, let’s explore how to set up your very own safety net. Below are some essential steps to consider:

1. Assess Your Travel Style

Consider how you travel—a spontaneous backpacker will face different risks than a luxurious traveler. Are you an adventurer who bravely navigates the wild terrains, or do you prefer sipping wine in a five-star restaurant? This impacts how you’ll build your fund!

2. Determine Your Budget

Establish a target for your travel emergency fund. Aiming for $1,000 might be a good starting point, covering unexpected costs like emergency flights or lodging. Regular international travelers might want to save even more—a good rule of thumb is setting aside 5-10% of your travel budget.

3. Set Up Automatic Savings

Pay yourself first. Create a separate dedicated account for your travel emergency fund and set up automatic transfers from your primary account. Even putting away $25 or $50 a month can lead to an impressive sum over time. It’s like planting a seed: the more you nourish it, the more it grows.

4. Stick to Your Plan

Life’s unpredictability can sometimes lure you to spend this stash on fun dinners or souvenirs. Remember: this fund is your shield. It’s for emergencies, not another mojito on the beach. Keep it off-limits unless the unexpected strikes.

5. Stay Informed About Travel Insurance

While we’ll focus on your emergency fund, it is essential to look into travel insurance that complements your fund. Policies can provide another layer of protection, especially for medical care abroad, trip cancellations, or lost baggage.

Lifehacks for Managing Unexpected Expenses

Now that we have your travel emergency fund set up, let’s share some practical lifehacks for avoiding unexpected expenses while you’re out exploring the world.

1. Familiarize Yourself with Local Healthcare

One of the wisest moves is to research healthcare and nearby facilities. In my travels through Thailand, knowing the closest good hospital made me feel at ease when my friend got food poisoning. Knowing where to go can mitigate stress during emergencies.

2. Keep Copies of Important Documents

Accidents happen. Ensure you have digital and physical copies of all crucial documents, like your passport, ID, and travel insurance policy. This simple practice can save you hours of panic should something go astray.

3. Always Have Small Local Currency

When visiting a new country, having a small amount of local currency handy can be invaluable. From those surprise taxi rides to sudden snack cravings, having local bills can save you from stress and unexpected conversion fees.

4. Share It With Your Travel Buddies

Traveling with friends? Discuss your respective emergency funds and establish a group code for handling emergencies. Establishing this camaraderie can create a sense of security in unfamiliar places.

Scenic Landscapes and Peace of Mind

When you travel with a safety net tucked away, the world opens its doors wider. You might find yourself wandering through vast lavender fields in Provence or standing atop the breathtaking cliffs of Moher, and that unburdened feeling makes those landscapes even more striking.

I distinctly remember my hike through the Scottish Highlands—every twist and turn, every cloud-streaked hill spoke to a part of me that craved more than just beautiful scenery. It was a heady mix of adventure and tranquility, knowing that should anything happen, I had both an emergency fund and a warranty of travel insurance protecting me.

This peace of mind is golden, allowing you to savor each sunset without the shadow of a potential crisis darkening your horizon. Each experience is vivid, each moment rich, transforming a journey not only into memories but stories to live on in conversations long after you’ve returned home.

Conclusion

Creating a travel emergency fund is not just about mitigating risks; it’s about embracing the beauty of unpredictability. Life will surprise you and travel will inevitably put you in unfamiliar positions. By preparing for the unexpected, you grant yourself the freedom to explore the world without fear—knowing you have a financial safety net when needed.

So, fellow travelers, as you continue your journey, remember to plan for the unexpected with a travel emergency fund. It’s not merely a financial strategy—it’s peace of mind, adventure, and living life fully.

Want to stay updated on the latest travel tips? Check out our Travel Tips section for the latest advice. Looking for lifestyle inspiration? Explore our Lifestyle category, and discover amazing destinations here.

Don’t forget to connect with us on YouTube, or follow our adventures on Instagram and Pinterest. Embrace the journey, prepare for the unexpected, and may every adventure lead you to beautiful memories! Safe travels!