Ever found yourself daydreaming about white sandy beaches or the colorful streets of a European city? You’re not alone. Travelers like us have a special place in our hearts for wanderlust. Yet, as we all know, the road to those dream adventures often travels through the rugged terrain of budgeting. That’s where a travel savings account comes in, like an old friend, waving a banner of hope and organization. Today, let’s dive into how to set up that travel fund and let your savings flow like a river heading toward the ocean of your travel dreams.

Why a Separate Travel Savings Account?

Imagine this: you’re sipping a cocktail on a sun-drenched beach, listening to the gentle waves kiss the shore. Now, imagine that the money you’re spending on that glorious moment isn’t depleting your monthly budget for groceries and bills. This is the magic of a separate travel savings account.

When you keep your travel funds separate from your regular spending money, budgeting and tracking become a breeze. You’ll know precisely how much you’ve set aside for each adventure, granting you peace of mind. The fewer financial headaches you have before your vacation, the more you can revel in the thrill of planning and anticipation.

Key Steps to Set Up Your Travel Savings Account

Setting up a travel savings account isn’t just about opening a new bank account. It’s a journey of its own. Here’s a roadmap to guide you through the process:

Step 1: Choose the Right Savings Account

First, let’s talk about choosing the right account. You want a high-yield savings account that offers competitive interest rates and minimal fees. Imagine a garden, where your savings can blossom instead of being choked by weeds of unnecessary charges. Look for accounts with zero monthly fees—that’s good gardening!

Banks that offer better interest rates allow your money to taste the thrill of growth while keeping your expenses low. Take a moment to compare your options as if you were picking the ripest fruit at the market.

Step 2: Determine Your Travel Budget

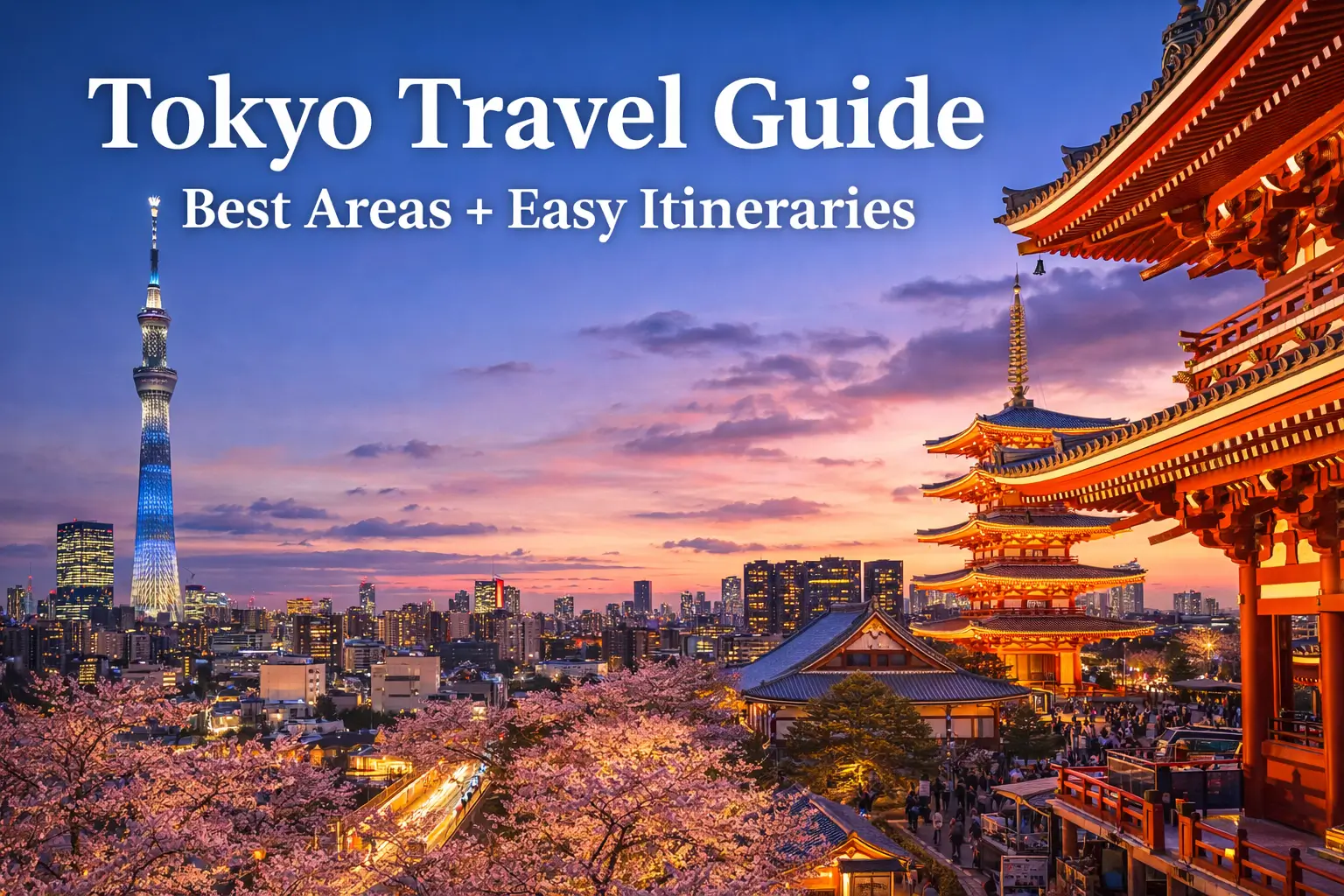

Picture yourself strolling through the streets of Kyoto or enjoying a sunrise in Santorini. But to get there, you need a budget. Research and estimate your travel costs—flights, accommodations, food, activities. Craft a detailed budget that lays out these expenses, almost like a treasure map leading you to your destination.

Once you have a solid number, determine how much you need to save each month. This way, you’ll have a clear vision of your savings goal, making it easier to stay committed and inspired.

Step 3: Automate Your Savings

The beauty of automation is its hands-off approach. Set up automatic transfers from your checking account to your travel fund, like a river of savings flowing effortlessly to nourish your dream. By doing this, you’ll effortlessly contribute to your account without the temptation of using that money elsewhere.

Imagine how satisfying it will be to see your travel savings grow while effortlessly setting aside cash for your adventures!

Step 4: Boost Your Savings

Sometimes we need a little extra push to reach our travel savings goal. Financial windfalls—such as tax refunds, work bonuses, or even a side hustle—can pump life into your travel fund like a sudden summer rain.

Consider taking on a freelance job or participating in gig economies where you can earn money doing something you enjoy. Pour these extra earnings into your travel account and watch your fund swell, filling you with excitement.

Tips for Success

Now that you’ve set the foundation for your travel savings account, let’s add some tips to your toolkit:

Set Clear Goals: Whether it’s a week in the Maldives or a culture-packed trip to Barcelona, specifying your destination and timeline will keep your motivation high. Picture each milestone vividly, and celebrate that achievement when you reach it!

Reward Your Progress: Don’t forget to treat yourself along the way! Perhaps enjoy a fancy dinner or buy that travel book you’ve been eyeing. This maintains your enthusiasm for reaching your travel savings goal.

Stay Disciplined: To keep that savings flowing, set reminders or even a visual reminder of your goal on your fridge. You’ll see it every time you’re tempted to dip into the funds for a coffee.

Scenic Landscapes and the Joy of Traveling

Nothing ignites wanderlust as easily as the landscapes you dream of exploring. Picture this: the austere beauty of the Scottish Highlands or the shimmering turquoise waters of Bora Bora. These visions keep our hearts racing, pushing us to save more fervently.

Every trip tells a story, and I remember the first time I laid eyes on the ancient ruins of Machu Picchu. Standing there atop the mountains, I realized those moments of awe are everything. They’re the treasures we save for, and capturing them — that’s a must.

Each landscape speaks its own language: the rustling palm trees whispering secrets of faraway lands, the bustling markets alive with color and aroma. Investing in experiences, especially through a well-planned savings account, gives you access to that vibrant world.

Conclusion

So, dear friends, as you embark on this journey of setting up your travel savings account, remember that every dollar saved brings you one step closer to adventures waiting on the horizon. Maintain discipline with your spending, automate your contributions, and enjoy the little wins along the way.

Mentally packing your bags for that dream vacation isn’t just a daydream; it’s your future, crafted with thoughtful planning and focused dedication. Now, go on—open that savings account, plot your escapades, and let your adventurous heart lead the way.

Want to stay updated on the latest travel tips? Check out our Travel Tips section for the latest advice. Looking for lifestyle inspiration? Explore our Lifestyle category, and dive into amazing destinations at Destinations. Don’t forget to connect with us on YouTube, or follow our adventures on Instagram and Pinterest.

Wishing you well on your travel-saving journey!